Defence Stocks - Valuations after deep correction

In this post we will look at the defence stocks, how they were valued, and what are the causes of the sudden downfall in their stock prices.

The Gold Rush period

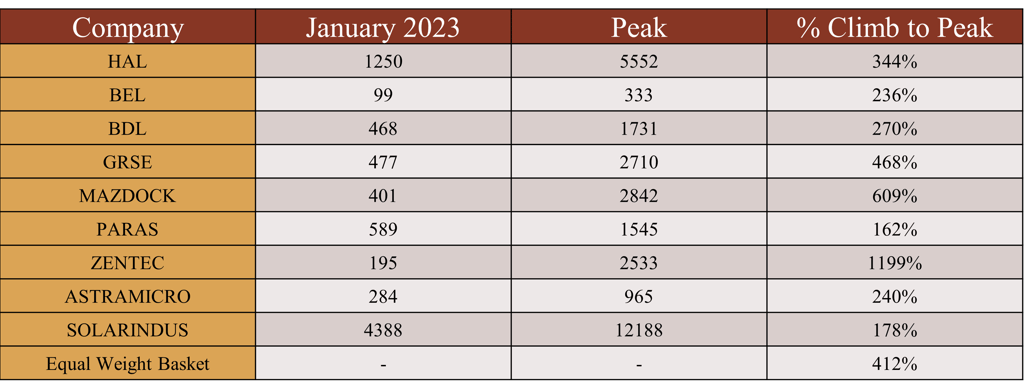

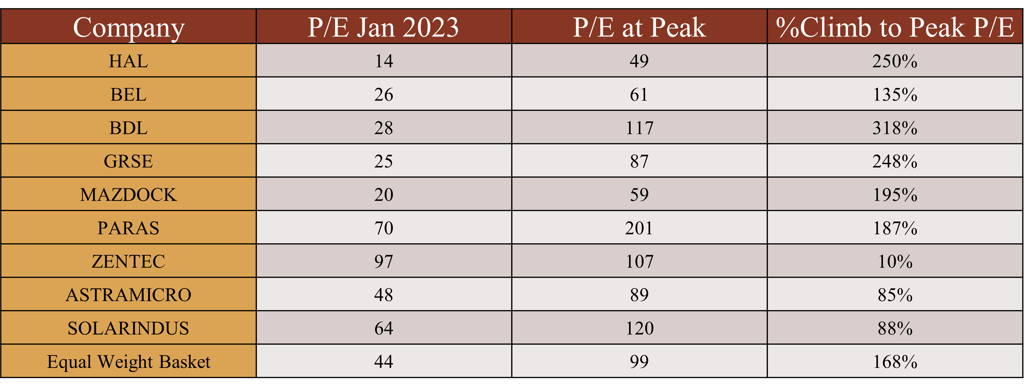

From Jan 2023 to Sep 2024. the defence stocks gave multi-fold returns. Some of the stocks gave upto 600% returns at their peak. Here is the look of defence stocks and how they performed during this period.

Disconnect from Earnings

In the same period, the share prices moved disproportionately to the profit of the company.

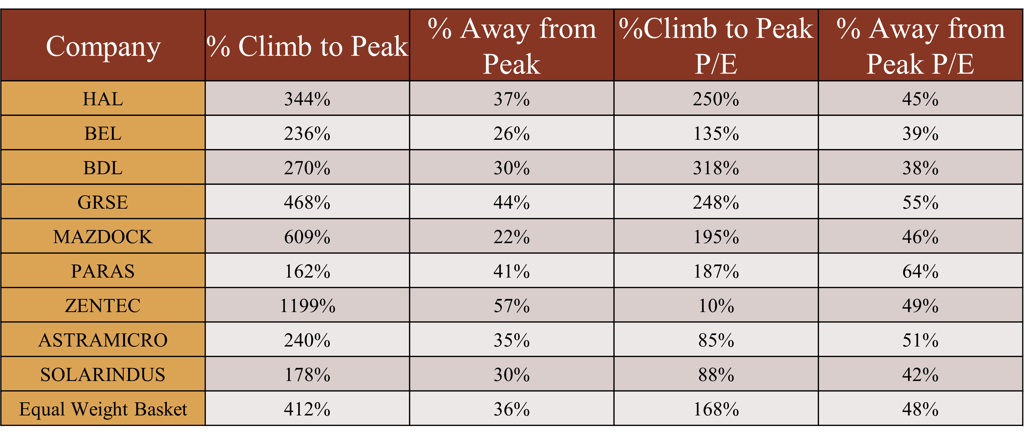

The Rise and Fall

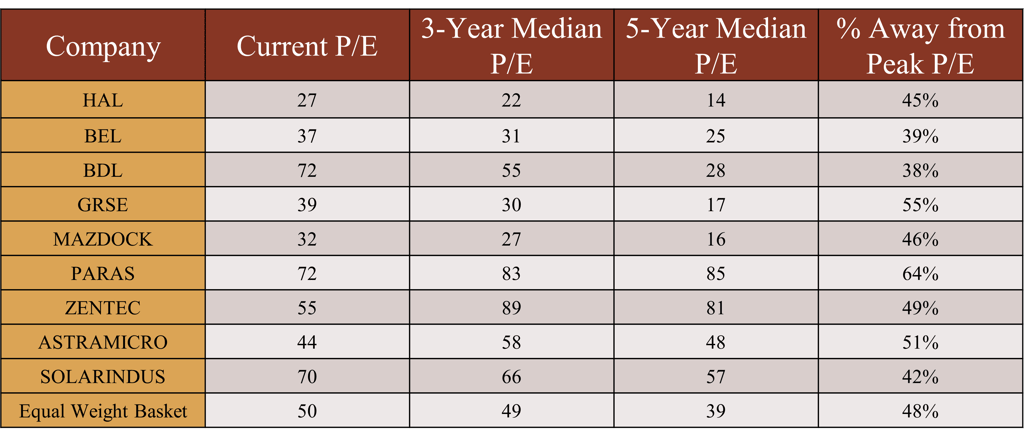

The following table shows how the prices and valuations peaked and how sharply they fell

Current vs Historical Valuations

Observations

Perceived valuation is derived from many factors like Market sentiment, growth trajectory, tailwinds, historical valuations and many more...

Across the board, it was observed that defense stocks gave multi-fold returns with a equal weight basket giving us 4X returns in 18 to 24 months

These returns were not in line with the earnings growth of the companies. The earnings did not grow as fast as the prices.

Thus, the prices saw a deep correction

Interestingly, the P/E correction was deeper than the Price Correction

After the recent correction, some stocks are currently trading below their 3 year and 5 year median P/E multiples

Most of the basket stocks saw steep declines with decent earnings growth

The defense sector has a good tailwind but the recent run-up in prices was unjustified (In majority of the cases, barring a couple of outliers)

Interestingly, the basket P/E is a almost exactly at its 3 year median P/E. The valuations are becoming fair and friendly

This sector should see many re-ratings and new targets from large fund houses and research firms